What’s the Big Deal About a Pile of Rocks? The Diaoyu Island Incident

This past September, the world watched as the centuries-old feud between China and Japan reached epic proportions over a little-known chain of uninhabited islands in the East China Sea. Known as the Diaoyu Islands in Chinese, the Senkaku Islands in Japanese, both China and Japan claim them as their own and each seeks control of the oil-rich seabed that potentially lies beneath.

As Marcy Nicks Moody writes in Foreign Policy Digest (reprinted below), at stake with these islands is more than just a pile of rocks.

By Marcy Nicks Moody

Originally Printed in Foreign Policy Digest

DEVELOPMENTS

Last month, a Chinese fishing boat collided with two Japanese coastguard patrol ships off the coast of a small chain of uninhabited islands in the East China Sea. Japanese authorities took the boat’s crew into custody, and prosecutors debated whether to press charges against the boat’s captain for obstruction of justice. Demanding the captain’s release, Beijing made strenuous arguments invoking Chinese sovereignty and human rights. Chinese Premier Wen Jiabao refused to meet with Japanese Prime Minister Naoto Kan during a recent United Nations Summit meeting in New York and insisted that the conflict be resolved through diplomatic channels, while simultaneously suspending all mid- and high-level political contact between the two countries. When the fishing boat captain was released, Beijing responded by insisting that Japan issue a formal apology and provide financial compensation. Japan, in turn, argued that China should compensate Japan for the damage done to its naval ships. Whether the collision was intentional is unclear, and it is unlikely that further light will be shed on the subject.

BACKGROUND

If the scale and particularly bitter nature of the diplomatic denouement following this small maritime accident strikes readers as odd, it should. These events put into sharp relief the changing security landscape that both Asia and the United States face today in the Asian maritime. They may also provide some insight into how China intends to conduct its increasingly forward facing maritime and energy security policy.

The islands near which the collision occurred are a matter of ongoing dispute between China and Japan that dates back for at least 40 years. Although the Senkaku Islands (called the Diaoyu Islands, in Chinese) are effectively a pile of uninhabitable rocks, it became known in the 1970s as an area potentially rich in oil and gas deposits in the surrounding waters, control of which could improve either country’s energy security dramatically. At present, the islands are controlled by Japan, but claimed by China. Although both have legitimate grounds for their claims, there is no foreseeable end to the dispute in sight. As Japanese authorities held the Chinese fishing boat captain on the basis that they might charge him with a violation of Japanese law, they were implying that these waters are, indeed, Japanese. For this reason, it is not entirely surprising that China would respond with such vociferous complaints as it did. What was surprising were the unannounced measures that China also took.

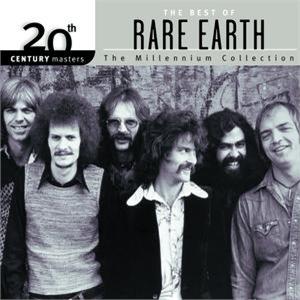

In addition to arresting four Japanese citizens in China for spying, which may have been coincidental, China appears to have suspended the export of rare earth minerals to Japan. Rare earths are elements in the Earth’s crust. Although they exist in miniscule concentrations, they are crucial to a range of modern technologies, including car batteries, wind turbines, and many other electronics. China mines approximately 97 percent of the world’s rare earths and, given the relative importance of electronics manufacturing to the Japanese economy, this move has the potential to be extremely damaging to Japan. No one from the Chinese government announced the suspension, and officials from the Chinese Ministry of Commerce (MOFCOM) have denied any sort of embargo. Chinese officials have, however, made public that they are contemplating fining Toyota Motor Company’s Chinese operations for various violations, including illegal rebates to Chinese car dealerships. While it is possible that the dispute with the trawler captain, the suspension of rare earths exports, the arrests, and the Toyota fines are all coincidental, it seems more likely that China is manipulating its economic and commercial relationship to gain leverage in its dispute with Japan over the Diaoyu/Senkaku Islands.

China has similar ongoing disputes over other chains of islands in the South China Sea with its Southeast Asian neighbors—in particular, Vietnam. Like the Senkaku/Diaoyu Islands, the waters surrounding the Spratly and Paracel Islands are believed to be rich in oil and natural gas, in addition to their valuable proximity to busy shipping lanes. The U.S. government inserted itself into the dispute in July, when Secretary of State Hillary Clinton announced that the United States would be willing to facilitate multilateral talks on the issue. She insisted upon U.S. neutrality, but argued that the United States has a strong interest in preserving free shipping in the region. Not surprisingly, a number of Southeast Asian countries welcomed the announcement, while China, caught off-guard by the announcement, maintained that the talks should be undertaken in a bilateral format.

ANALYSIS

China has not been the positive, productive, and cooperative international partner that the Obama administration seems to have been expecting two years ago. On the security side, cooperation on the North Korean question has disintegrated; Beijing has refused to move forward on sanctions against Iran; and U.S.-China military-to-military relations are increasingly strained. On the economic side, meanwhile, China has not allowed its currency to appreciate materially; it has recently placed steep tariffs on some U.S. exports, and the business environment is widely acknowledged to have become increasingly hostile to non-Chinese enterprises. If nothing else, Secretary Clinton’s July announcement is a mechanism for registering U.S. frustration with the current trajectory. Like China, Washington is also willing to play the zero-sum game.

The disputes over the Senkaku/Diaoyu, Spratly, and Paracel Islands are all based, at least in part, in China’s quest for greater energy security. At the same time, Beijing has taken an increasingly aggressive stance in a range of its foreign policy dealings, both with the United States and with its Asian partners. Given the trend of global economic interdependence that relies more and more heavily on China’s mammoth economy, Beijing’s recent behavior could forecast some serious struggles in the future, as China manipulates its growing commercial influence to leverage its position in the Asian security landscape.

Marcy Nicks Moody writes about China. In 2007-08, she was a Fulbright Scholar in China, where she was also a Research Fellow with the U.S.-Asia Law Institute. She received an M.A. in East Asian Studies from Columbia University and graduated from Brown University.

On Facebook

On Facebook By Email

By Email